Puerto Rico News & Articles

Home / Blog

How can Puerto Rico lower your taxes?

The Puerto Rico tax breaks are legal and real! The law allows for Puerto Rico to tax its residents on income earned there, which allows PR residents to legally avoid some or all IRS tax. Puerto Rico has set up a program of tax breaks for investors and business owners to attract revenue into the Puerto Rico economy.

Charity Donation Requirements

Most Puerto Rico investors who apply for Act 60 or Act 22 must donate to a Puerto Rico charity each year. Note: there is no charity requirement for business owners if you chose not to pursue the Investor incentive. Rules for Act 60 and Act 22 Charitable Donations...

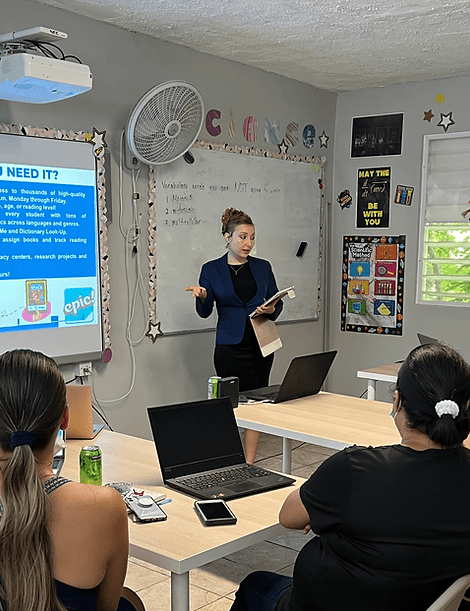

Tech My School – Free Webinar

Act 60 Investors (and some Act 22 Investors) are required to make annual donations to qualifying Puerto Rico non-profits. Our clients often ask if there are particular PR charities that we endorse, and after some consideration of many worthy non-profits, we are...

Puerto Rico Labor Laws

Puerto Rico’s labor laws have some critical differences that are important to know if you have employees here. The upcoming webinar will feature a PR labor attorney who can advise about these differences.

Puerto Rico Residency – Free Webinar

Establishing legal, "bona-fide" residency is the first step in a successful strategy to take advantage of Puerto Rico's tax incentives. Maintaining it ongoing is also critical! Should you be audited and found to not be in compliance with the Puerto Rico residency...

We Can Help

Our company helps people like you take advantage of Puerto Rico’s excellent tax incentives! We can help you determine which tax incentives are right for you, help you plan your residency and relocation strategy, and simplify the entire process for you.

Contact us for a free initial consultation.