The Cost of Living in Puerto Rico

Comparing the Cost of Living in PR to Major U.S. Cities

For many individuals and businesses looking to relocate, Puerto Rico offers not just stunning beaches and a tropical lifestyle but also significant financial advantages. The cost of living in Puerto Rico is often lower than in major U.S. cities, making it an attractive destination for those seeking affordability and tax benefits. But how do everyday expenses compare, and how do tax incentives balance out living costs? Let’s break it down.

Comparing Puerto Rico’s Cost of Living to Major U.S. Cities

In general, Puerto Rico’s cost of living is lower than that of major metropolitan areas like New York, San Francisco, or Miami. While some expenses, like electricity and imported goods, can be higher, the overall affordability—especially in housing—makes Puerto Rico an attractive option. To provide an accurate comparison, we used data from sources such as Numbeo, Expatistan, and local market research as of 2024.

| Expense Category | Puerto Rico (Avg.) | New York City | San Francisco | Miami | Median U.S. City |

|---|---|---|---|---|---|

| Rent (1-bedroom, city center) | $1,000 – $1,500 | $3,500+ | $3,200+ | $2,500+ | $1,500 – $1,800 |

| Utilities (electricity, water, etc.) | $150 – $300 | $150 – $200 | $100 – $200 | $120 – $180 | $150 – $250 |

| Internet | $50 – $90 | $60 – $100 | $60 – $100 | $50 – $90 | $60 – $80 |

| Groceries (monthly) (Household of 2) | $500 – $700 | $600 – $1,000 | $700 – $1,200 | $500 – $800 | $450 – $700 |

| Dining Out (mid-range restaurant for two) | $50 – $80 | $80 – $120 | $90 – $150 | $70 – $100 | $50 – $80 |

| Gasoline (per gallon) | $4.00 – $4.50 | $3.50 – $4.50 | $4.00 – $5.00 | $3.50 – $4.50 | $3.50 – $4.00 |

| Public Transportation (monthly) | $50 | $127 | $81 | $112 | $70 – $90 |

(Related: Cost of Living in San Juan, PR)

Budget Breakdown: Everyday Expenses in Puerto Rico

1. Housing in Puerto Rico

The cost of housing in Puerto Rico is significantly lower than in major U.S. cities. Rent for a middle-class one-bedroom apartment in San Juan’s prime locations, like Condado or Old San Juan, ranges from $1,000 to $1,500, whereas high-end apartments in these areas can exceed $2,000 per month. By comparison, similar apartments in New York or San Francisco cost over $3,000 per month.

For those looking to buy, real estate prices can be attractive, with beachfront condos available for as low as $200,000 to $400,000 in some areas. Additionally, Puerto Rico offers luxury gated communities and high-end condo buildings with extensive amenities for those seeking a more upscale lifestyle.

Tip: If you’re flexible with location, areas outside of San Juan—such as Mayagüez, Ponce, Rincón or other towns outside of the main metro area—offer lower rent while maintaining a high quality of life.

(Related: Puerto Rico Real Estate Market)

2. Utilities in Puerto Rico

Utility costs in Puerto Rico can be higher than on the mainland due to the island’s reliance on imported fuel for electricity. The average electricity bill runs between $150 and $300 per month, depending on air conditioning use. The power grid in PR is also a bit fragile, so it is important to look into mitigation strategies such as generators and solar panels should you experience a power outage.

Tip: Solar energy is becoming more popular, and many homeowners invest in solar panels and battery backup systems to reduce electricity costs and avoid being without power. Additionally, solar panel installations may be eligible for tax credits, providing further incentives for homeowners looking to lower their energy bills.

3. Food & Groceries in Puerto Rico

Grocery prices are generally higher than in the U.S. mainland due to import costs. Expect to pay around $300 – $400 per person per month for groceries. Local markets offer fresh produce at lower prices, so shopping at farmers’ markets or buying local brands can help save money.

Tip: Opt for locally grown fruits, vegetables, and seafood to save on imported grocery costs.

4. Transportation in Puerto Rico

Car ownership is common in Puerto Rico, and gas prices are comparable to mainland averages, around $4.00 – $4.50 per gallon. However, vehicle purchase prices tend to be higher due to import taxes, as there are no cars manufactured in Puerto Rico. Public transportation options are limited outside of San Juan, so having a vehicle is often necessary.

Public Transit: The Tren Urbano metro system operates in the San Juan metropolitan area but it is not as extensive as subway systems in major U.S. cities. While it provides some connectivity, most residents still rely on personal vehicles or rideshare services for daily transportation.

Tip: If living in San Juan, you can reduce costs by using Uber (currently the only rideshare app in PR) or walking. Several attractive neighborhoods allow residents to walk to most daily necessities, minimizing the need for a car.

How Tax Savings Can Offset Living Costs

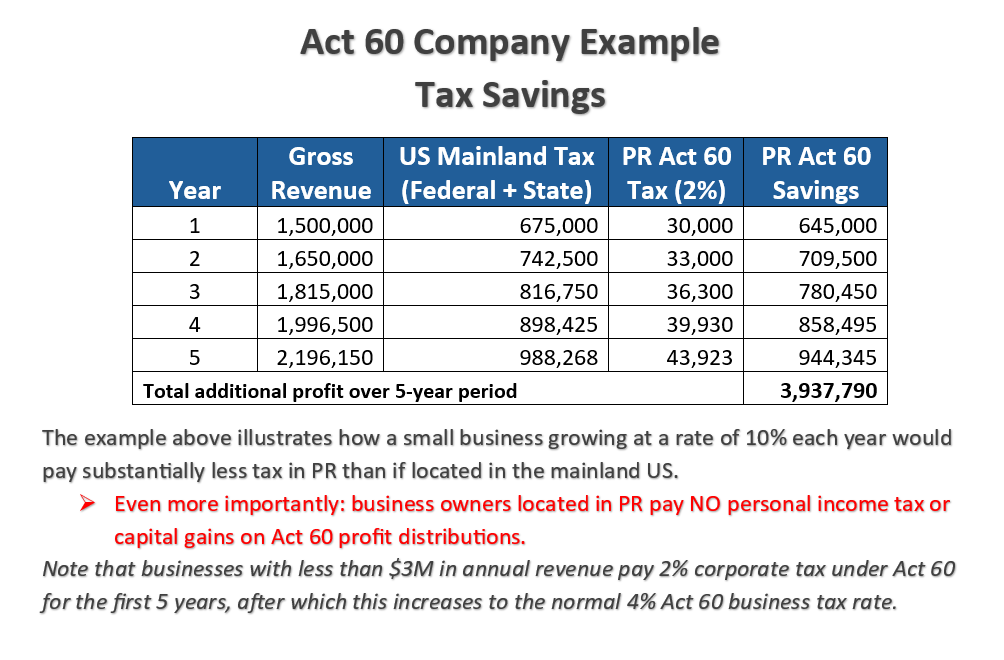

One of the biggest financial incentives for moving to Puerto Rico is the potential tax savings under Act 60 (formerly Acts 20 and 22, and others). Here’s how these world-class tax incentives can benefit you:

- 0% Capital Gains Tax – Investors relocating to Puerto Rico can benefit from no tax on both short and long-term capital gains, compared to the 15-20% tax rate on the mainland.

- 2 or 4% Corporate Tax Rate – Entrepreneurs setting up qualifying businesses in Puerto Rico can enjoy a flat 2 or 4% corporate tax rate versus the 21% federal rate in the U.S.

- No State Taxes – Unlike the mainland, which levies both state and federal taxes, residents of Puerto Rico are only taxed by PR for income sourced there.

For example, a business owner earning $500,000 per year could potentially save over $100,000 in taxes compared to living in a high-tax state like California or New York. (This estimate is based on Puerto Rico’s tax incentives versus combined federal and state tax rates in high-tax jurisdictions. Actual savings depend on individual circumstances, and consulting a tax professional is advised. Contact Puerto Rico Advantage to schedule a free initial consultation)

For more details, see our overview of the Act 60 tax incentives.

(Related: Puerto Rico Act 60 Guide)

Final Thoughts: Is Puerto Rico Affordable?

For those relocating primarily for tax benefits, Puerto Rico offers substantial savings. While some costs, like utilities and groceries, can be higher, the reduced housing costs and major tax incentives often result in a significantly improved financial outlook.

For those less concerned about affordability but looking for a transparent picture of what to expect, Puerto Rico provides a mix of high-end and budget-friendly living options. Luxury accommodations, fine dining, and premium services are available, but so are cost-saving opportunities for those who seek them.

If you’re considering a move, it’s important to weigh not just the numbers but also the lifestyle trade-offs. If you’re looking for an island paradise with financial perks, Puerto Rico may just be the perfect fit.

Need help with your move? Contact Puerto Rico Advantage for guidance on relocation, tax incentives, and settling in!